Climate, investing, philanthropy – and you

To avoid climate catastrophe, we must invest in the most effective “emergency brake” climate solutions as quickly as possible – through philanthropy, private investment, corporate spending, and government funding.

This will take a strategic, ecosystem-style approach in order to mobilize more climate funding and align existing funding with proven climate science and solutions, such as Project Drawdown’s scientific analysis showing that there are nearly 100 technologically and financially viable solutions for reducing, avoiding, or sequestering emissions.

During this webinar, Stephan Nicoleau, partner with FullCycle, sat down with Project Drawdown executive director Jonathan Foley to discuss the current state of climate philanthropy and investing, and where we need to go from here to urgently address climate change. They also talked about the new Drawdown Labs Capital Accelerator, efforts to reduce global methane emissions, insights from Climate Week NYC, and what to expect at COP 28.

Stephan Nicoleau is an investor, advisor, and founder with more than 15 years experience investing and operating in social and environmental impact. He is a partner at FullCycle, a private equity firm focused on accelerating climate-critical infrastructure solutions. He heads capital solutions for the firm, managing institutional relationships and the firm’s capital formation for its fund vehicles. In addition to serving on the board of Project Drawdown, Stephan is also an active mentor to entrepreneurs.

Key Links

How to Use the Drawdown Roadmap

Top Takeaways

1) Capital is morally neutral, but how we deploy it makes all the difference. It can help or harm our planet; which it does is up to us.

2) Some climate solutions are still in need of support from government or philanthropy to get to a viable scale. But many if not most investments in climate solutions can provide returns on investment as good as, or better than, those for destructive investments.

3) Investors are increasingly directing funding to climate-positive activities, but not enough or fast enough. To reach the US$3–5 trillion needed to turn the climate tide, we need a far greater—but still achievable—level of investment at a global scale.

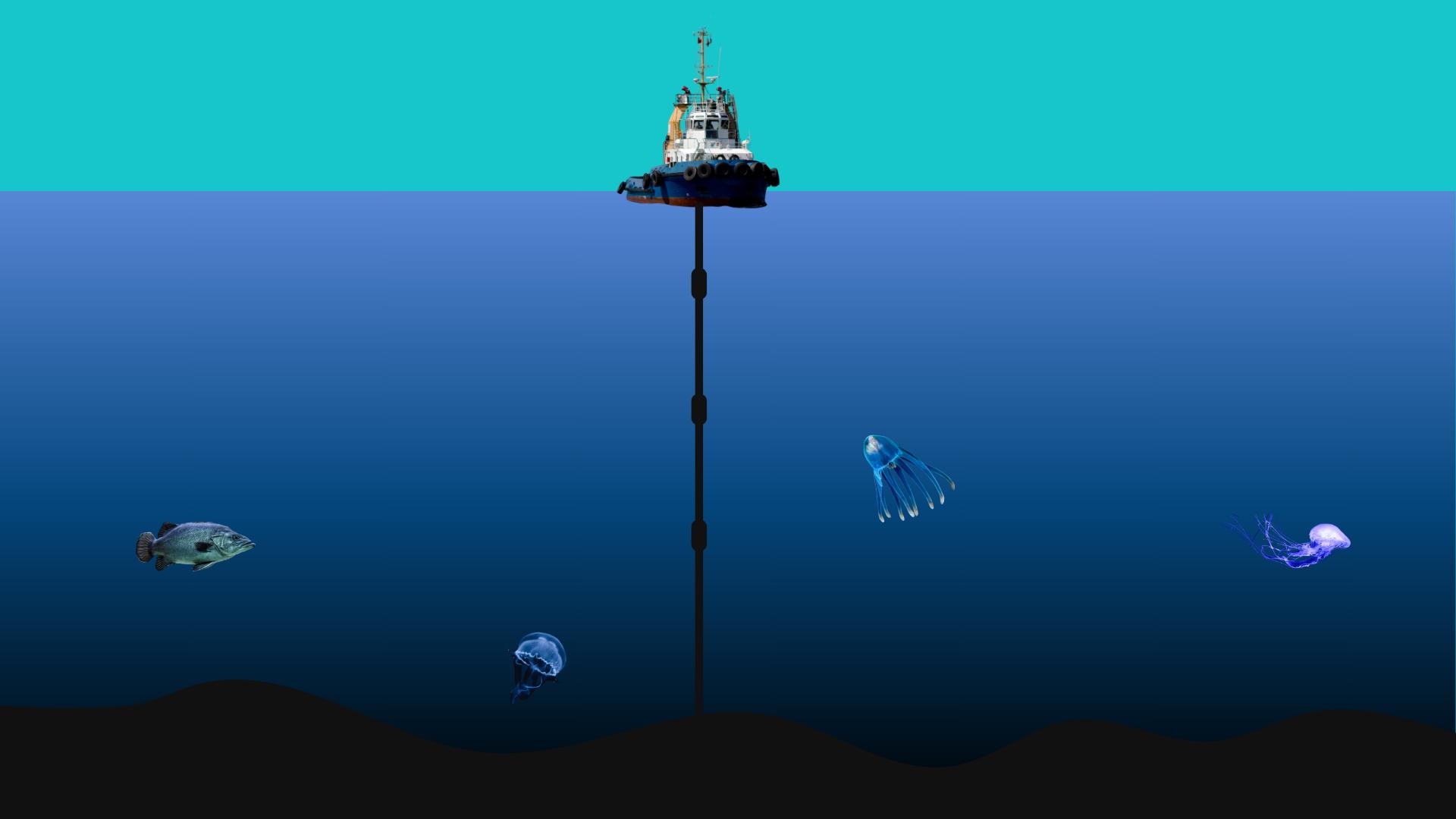

4) To maximize the climate benefit that money can achieve, we need to strategically invest in climate solutions that provide the greatest return on investment in the near term (so-called “emergency brake” solutions). Top among these is reducing methane emissions from agriculture, fossil fuel production, and landfills.

5) Whether you are an investor, philanthropist, funder, or individual with a bank account, where you direct the funds you control could offer one of the biggest opportunities you’ll ever have to influence the quality of life on our planet for generations to come.

This webinar is part of Project Drawdown’s new monthly Drawdown Ignite webinar series. Drawdown Ignite provides information and inspiration to guide your climate solutions journey. View past Drawdown Ignite webinars on YouTube, and visit our Events page for updates on future webinars.